National Real Estate Transaction Changes

Some of you may have heard of changes in USA law on how Real Estate transactions are to be negotiated from this moment on. We have prepared a video that can provide some insight as to what these changes are and how Penner Group Properties has been ahead of the game in preparing for these changes!I

Read More

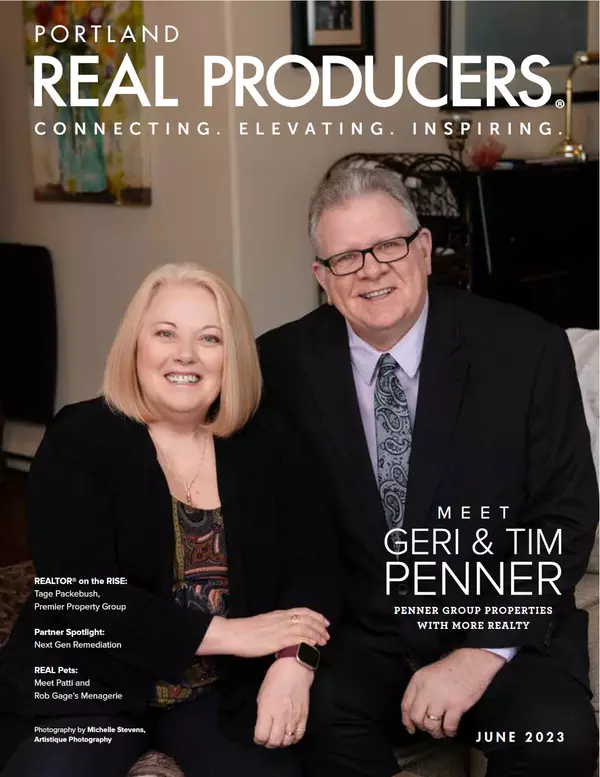

Portland Real Producers Feature - June 2023

Read More

A Look Into The Markets - April 4, 2025

This past week, interest rates touched the lowest levels of the year. Let's break down what happened and preview what's ahead."Well, It's Safe to Dance, It's a Safety Dance" - The Safety Dance by Men Without Hats. Bonds Love Uncertainty Amidst all the uncertainty around tariffs, investors bought

Read More

Categories

Recent Posts