A Look into the Markets - February 14, 2025

"You see inflation and taxation have taken over our nation."- Inflation by Earnest Jackson

Surprise Inflation Spike in January

On Wednesday, the consumer price index for January was released. Unfortunately for mortgage and housing, there was a surprising jump in prices. The headline CPI, which includes food and energy, rose by a whopping 0.5% versus the 0.3% expected.

This hotter-than-expected monthly reading in January elevated CPI to 3.0% from 2.9%. The more closely watched Core CPI, which removes food and energy, rose by 0.4% versus the 0.3% expected. This elevated Core CPI to 3.3% from 3.1%.

Shelter, transportation, and energy were the main reasons for the elevated inflation. Since inflation is the arch-enemy of bonds, we witnessed a sharp sell-off in bond prices resulting in a spike in rates.

It is important to note a few things. First, this reading is backward-looking for January, and financial markets attempt to price where inflation and economic activity are going to be six months from now. So, while this inflation theme was unnerving to mortgage and housing, this story can change very quickly.

Additionally, when the Fed wants inflation down to its 2.00% target, they are not talking about Core CPI, which is now running at 3.3%—but Core CPI, which will be reported at the end of February. That current measure of inflation is hovering at 2.8% annually.

Fed Chair on Capitol Hill

Another big event this week was our Fed Chair Powell on Capitol Hill for his semi-annual testimony. The big takeaway? The Fed is in no rush to cut rates. He also reiterated that the economy is strong, the labor market is tight, and inflation remains elevated but closer to the Fed's target.

After the CPI and Fed testimony, markets are now pricing in just one rate cut expected to come around late September.

China's Economy Sputters

China's economy is still struggling with significant deflation in its housing market. Unlike the U.S. housing market, in China, there remains an abundance of housing supply and low rates, and no one wants them. Demand for housing is very low, and it is hurting their overall economy.

One by-product of the weakness in China is downward pressure on oil prices. China is the second-largest oil consumer, accounting for nearly 16% of the global market, sitting only behind the United States. We have witnessed oil slide from $80 to near $70 in recent weeks. This is in part due to the China story. With fresh tariffs coming with China, it is not clear what is next for the country and thus the prices of oil.

One thing we know is that lower oil prices generally lead to lower inflation pressures and thus lower rates.|

30-yr Mortgage Rates |

February 13, 2025 |

|

10-year Note Yield |

February 14, 2025 |

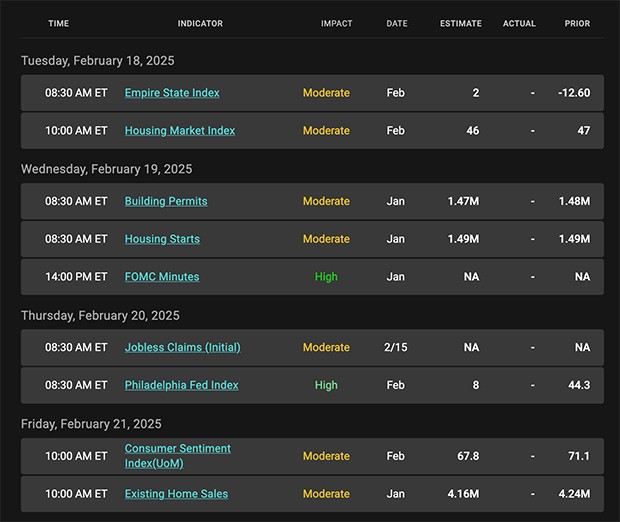

Looking Ahead

If you look at the right side of the chart, you can see how prices have drifted slightly lower in recent days causing the modest spike in mortgage rates

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224