A Look into the Markets - February 21, 2025

"Minute by minute by minute by minute I keep holding on (oh, baby)"- Minute by Minute by The Doobie Brothers.

Three weeks after every Fed meeting, the Minutes from that meeting are shared with the public. The minutes are intended to provide everyone with a clear picture of what was discussed and by whom at that meeting. So, as always, this is a market mover, and it was once again this week.

"Participants indicated that, provided the economy is near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate." - FOMC Minutes, January 2025 meeting

Outside the technical jargon, this statement suggests the Fed is going to hold off on cutting rates further until more signs of disinflation or a lower inflation rate emerge.

This should be no surprise, as inflation continues to run at 2.8%, above the Fed's target of 2%. Additionally, with uncertainty around new economic policy and tariffs, it is wise for the Fed to sit and wait.

"Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event." - FOMC Minutes

This line helped both stocks and interest rates improve. Why? It suggests the Federal Reserve may halt the quantitative tightening or balance sheet reduction process, which has been draining money from the financial system and tightening financial conditions. By halting this process, the markets see the Fed potentially buying bonds to maintain the size of the current balance sheet, rather than allowing it to shrink further. This potential measure by the Fed also helps maintain market calm, as any potential market disruption caused by the debt ceiling debate would be averted.

The punchline? Ending or pausing balance sheet reduction would create market certainty and likely help prevent rates from increasing, much like it did back in May 2024.

Housing Starts Drop in January

Single-family housing starts fell 8.4% in January. A sizeable chunk of this decline is attributable to frigid weather across the country. Going forward, there is uncertainty about how tariffs could impact housing as most products needed to build a home, like lumber and concrete, are imported.

Walmart Warning

Retail giant Walmart issued a disappointing sales forecast. Walmart is viewed as a barometer of consumer spending. If the consumer is pulling back, that is a bad thing which stocks hate. Bonds, on the other hand, love bad news and this event helped rates improve last Thursday.| 30-yr Mortgage Rates | 20-Feb-25 | |

| 6.85% | ||

| -.02 WoW (6.87%) | -.05 YoY (6.90%) | |

| 10-year Note Yield | 21-Feb-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom line: Interest rates are moving sideways and are threatening to break out to new 2025 lows. Word that the Fed may pause balance sheet reduction has helped rates improve and this may put a lid on rates in the near term.

Looking Ahead

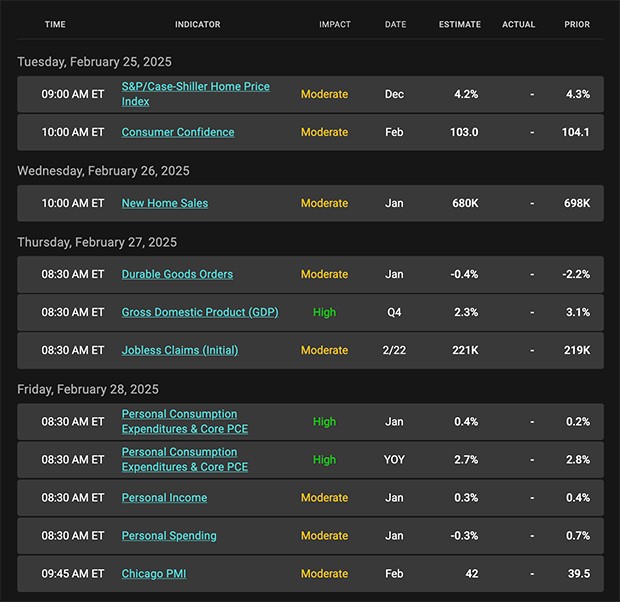

Next week, the markets, Fed, and investors will look to the Fed's favorite inflation gauge, the Core PCE, to see if pressures are building further or if they have cooled. Also, the Treasury will sell a total of $183 billion in 2, 5, and 7-year Notes.If you look at the right side of the chart, you can see how prices are hovering near two-month highs and threatening to make 2025 highs, which would equate to 2025 rate lows.

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224