A Look into the Markets - September 27, 2024

"Shout it, shout it, shout it out loud" – Shout it Out Loud - Kiss.

Mixed Fed Speak

With the blackout or "quiet" period over, Federal Reserve officials were out and about talking about where they see the economy and interest rates headed in the future. Fed Governor Michelle Bowman, who dissented at the previous Fed meeting and preferred to cut by only 0.25 basis points, was out saying the Fed should be methodical in cutting rates. Why? She doesn't feel the Fed has conquered the battle on inflation.

On the other hand, Chicago Fed President Austan Goolsbee said there was plenty of room for a lot of rate cuts. As of this moment, the Fed Funds Futures, which prices in the probability of rate cuts, is now suggesting the Fed Funds Rate will be 1.50% lower one year from now. Clearly, this is just a forecast, and any action will be based on the incoming data.

Big China Stimulus

China, which is enduring a sharp economic slowdown with rampant deflation, has taken drastic measures to create demand and attempt to stoke inflation. Unlike our housing market, in China, there is significant housing supply and very little demand to buy homes as prices keep falling (deflation).

In response, China has cut interest rates sharply and even purchased homes to remove the massive supply. It will take time to see if these measures work, and the unknown is what will be the impact around the globe if China is successful in creating demand and stoking inflation. Earlier in the week, oil prices had ticked higher in response to some of China's measures. If oil goes higher, it would be bad for long-term interest rates like mortgages.

Mortgage Demand Pops

The Mortgage Banking Association reported a solid uptick in mortgage applications week-over-week. This is a very positive sign as it highlights high demand for both purchase and refinance activity. It appears all that is needed is a downtick in interest rates for better days ahead. With the trend as our friend and the likelihood of lower rates over time, these numbers should also improve.

Incoming Data

Moving forward, the incoming data will be very important as it relates to interest rates. If the news comes in poorly, like an uptick in the unemployment rate, it will elevate the chances of not just more Fed rate cuts but deeper ones, like by 0.50%. On the other hand, if news comes in better than expected, it could stoke the idea that the Fed could pause cutting rates at any given meeting. Both scenarios would have an impact on home loan rates.

Bottom line: The trend in rates is our friend, with rates moving lower over time. The improvement will not be a straight line and will include both fits and starts based on the incoming data.

Looking Ahead

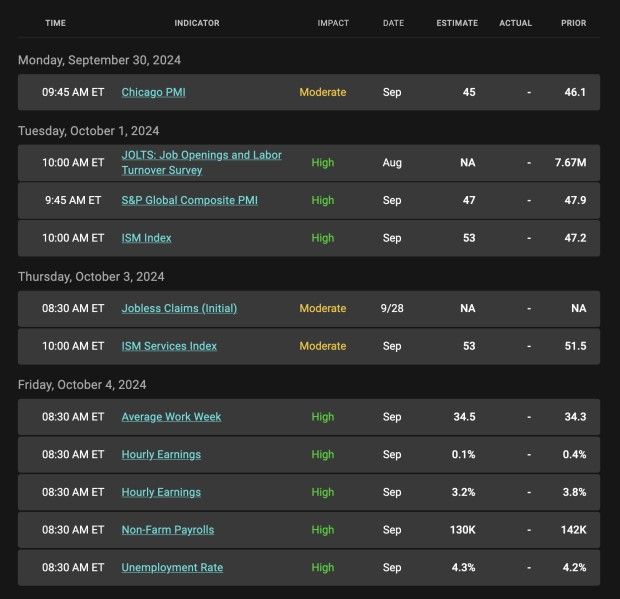

Next week is jobs week. The Fed is clearly more focused on the health of the labor market and stated that "further cooling would be unwelcome." Expectations are for the unemployment rate to hold steady at 4.2% and for 142,000 jobs to be created. If the numbers come in better than expected, the good news could take pressure off a deeper rate cut in the future. The opposite is true.

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224