A Look Into The Markets - April 11, 2025

"Sweet Emotion (Emotion)" - Aerosmith.

In what could be dubbed "tariff week," anticipation of tariffs being deployed globally on Wednesday sent shockwaves through bond markets. Interest rates spiked at historic levels worldwide. Here at home, the 10-year Treasury note experienced a wild 30-basis-point swing on Tuesday; dropping as much as 12 basis points during the day before closing up 18 basis points. This kind of volatility has only occurred three times in the last 27 years.

A key catalyst for the sell-off was a weak 3-year note auction on Tuesday, where buying demand hit a low point. This sparked fears about upcoming longer-term auctions, like the 10-year note and 30-year bond, amplifying market unease.

Wacky Wednesday

Then came Wednesday, and the tide began to turn. The 10-year note auction surprised to the upside with exceptionally strong results. Indirect bidders, foreign central banks, and institutions snapped up 87.5% of the $39 billion offering, a massive and unexpected wave of foreign buying.

The good news continued. About an hour later, the U.S. announced a 90-day pause on tariffs for any country not retaliating against initial tariffs, opening a window for negotiations. At the same time, tariffs on China were raised to 125%. Markets reacted dramatically. The Dow Jones, which had been in negative territory all day, surged over 3,000 points; the first time it's ever gained that much in a single trading day. The NASDAQ followed suit, climbing more than 10%, another historic milestone. In the bond world, the 10-year note hit 4.50% before reversing and closing near 4.35%, settling into relative calm.

Consumer prices fall in March

The closely watched Consumer Price Index (CPI) for March came in lower than expected. The headline number, which includes food and energy, showed a month-over-month decline, largely due to a sharp drop in energy prices in recent months. However, this is a backward-looking figure, and tariff-related uncertainties could complicate the inflation outlook going forward.| 30-yr Mortgage Rates | 10-Apr-25 | |

| 6.62% | ||

| -.02 WoW (6.64%) | -.26 YoY (6.88%) | |

| 10-year Note Yield | 11-Apr-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom Line: Interest rates are bouncing around in a volatile fashion, driven by tariff uncertainty, inflation fears, and speculation about Fed rate cuts. Keep an eye on the key levels mentioned above to gauge the next directional move.

Looking Ahead

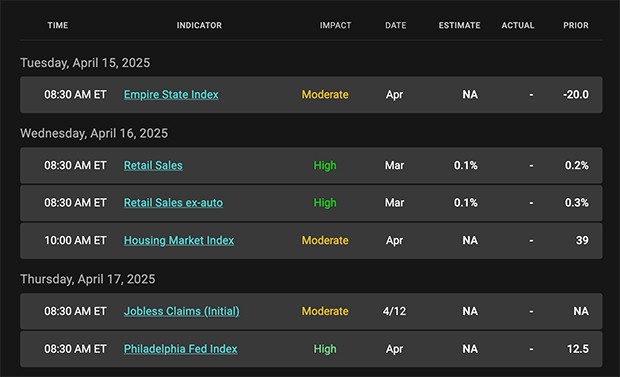

Next week is a light one for economic data, with only Retail Sales on the calendar. What's more likely to move markets are real-time headlines on trade negotiations. Adding to the mix, a series of Fed speakers could inject further volatility.The chart's right side shows large red candles, indicating sharp price drops and rising interest rates.

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224